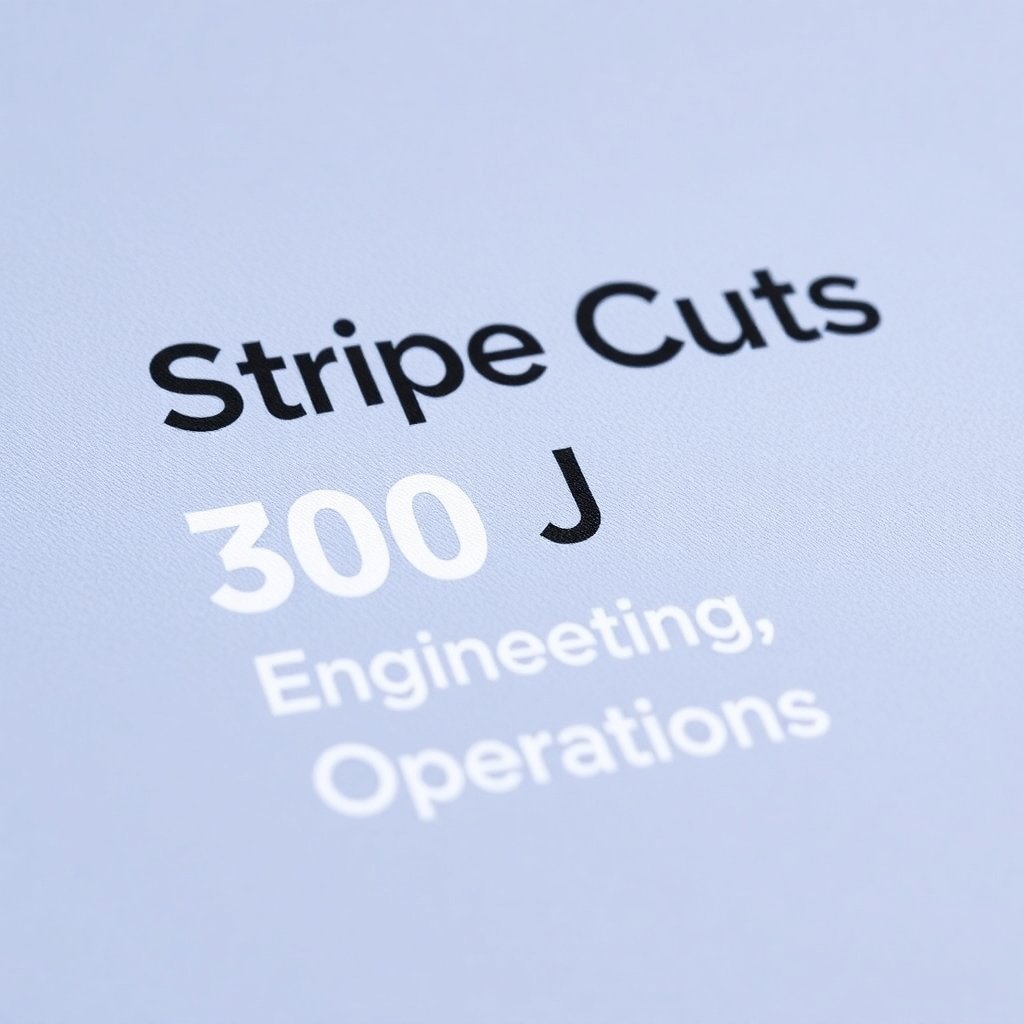

Stripe, one of the biggest payment processing platforms globally, has recently made headlines after announcing it will lay off 300 employees, affecting its product, engineering, and operations teams. This decision marks a significant shift for the company, which has been a powerhouse in the fintech space since its inception in 2010.

While such moves highlight the challenges facing the tech industry, they also shed light on Stripe’s evolving strategies for long-term growth, efficiency, and profitability. Below, we’ll explore why these job reductions occurred, how they reflect broader trends in the tech sector, and what this means for Stripe’s future.

Why Did Stripe Decide to Cut Jobs?

Laying off 300 employees isn’t a decision any company takes lightly—especially one as innovative and influential as Stripe. Here are the primary reasons this restructuring is taking place:

1. Streamlining Operations

Stripe’s decision is part of ongoing efforts to optimize its operational efficiency. Like any successful business, Stripe continually evaluates its departments to ensure that resources are being allocated effectively. By identifying areas of operational overlap, the company aims to maintain leaner teams that can better execute Stripe’s priorities.

2. Financial Pressures in the Current Economy

Amid rising global economic uncertainty, many tech companies are feeling the squeeze. Tech giants like Meta, Alphabet, and Amazon have also announced massive layoffs in 2023 alone. Stripe operates in a challenging environment where businesses aim to reduce costs without compromising growth potential. This round of job cuts aligns with a broader trend of cost-cutting measures prevalent across the tech sector.

3. Focus on Core Products

Stripe has built an ecosystem of financial tools that cater to businesses of every size. While diversification may be one of its strengths, maintaining focus on its most critical, revenue-driving products is essential. By realigning its workforce, Stripe seeks to prioritize the further development of key offerings such as payment processing and financial analytics.

A Broader Perspective on Tech Layoffs

Stripe’s decision to cut jobs reflects a much larger pattern in the tech industry. From early 2023, many established players have announced rounds of layoffs due to the slowdown in consumer spending, reduced venture capital funding, and increased operational costs.

1. A Post-Pandemic Reset

The tech sector experienced a massive boom during the pandemic, as businesses shifted online and digital payments surged. Stripe benefited significantly during this period, with millions of new users signing up to use its payment solutions. However, as the world returns to pre-pandemic norms, growth has slowed. Stripe, like many other companies, is now recalibrating for a more sustainable pace.

2. Rising Interest Rates

Economic factors, such as rising interest rates, are closely tied to broader labor market decisions. Higher interest rates impact startup funding and increase costs for businesses, putting pressure on even major players like Stripe to reevaluate their cost structures.

3. Valuation Drops

Stripe’s valuation has made headlines in the past, peaking at $95 billion after its Series H funding round in 2021. However, as venture capital dries up, funding rounds are either on pause or happening at lower valuations. This environment has added pressure to Stripe to show clear profitability and efficient spending to maintain investor confidence.

What This Means for Stripe and Its Workforce

While layoffs convey tough moments for organizational morale, history shows they are often strategic moves that position companies for future growth. For Stripe, three key implications stand out:

1. Resilience Amid Restructuring

Job cuts often serve as a litmus test for how robust organizational culture and resilience truly are. Stripe has built a reputation for innovation and employee-centric policies, and this transitional period is a chance for its leadership to reinforce those values.

2. Opportunities for Existing Employees

For the remaining workforce, the restructuring can mean more focus and resources for meaningful, high-priority projects. Employees are likely to see faster decision-making and clearer pathways for innovation within the product and engineering departments.

3. Ripple Effects Across Stripe’s Ecosystem

Stripe’s massive user base—from e-commerce startups to enterprise-level organizations—may have reasonable concerns about how these layoffs will impact levels of customer support and product delivery. However, if executed and managed effectively, this strategic realignment promises to make Stripe stronger and more adaptive, ensuring it stays a competitive leader in the fintech industry.

Is This Cause for Concern Among Stripe Users?

Stripe remains one of the most trusted names in digital payment processing. While news of layoffs can understandably create concern, it’s important to note that such reorganizations are often a proactive attempt to stay ahead of challenges. Here’s why users and partners of Stripe can remain confident:

Established Market Leadership: Stripe processed $817 billion in transactions in 2022, a testament to its continued relevance and strength.

Dedicated User Support: Despite staff changes, Stripe is known for maintaining robust support resources for users.

Continued Innovation: Realigning priorities may pave the way for exciting new features in existing products and innovative tools down the line. Stripe’s past track record of launching impactful solutions puts its ability to adapt on full display.

The Future of Stripe in Fintech

Stripe’s layoffs are one piece of a much larger puzzle in its strategic roadmap. The fintech landscape is evolving, and so is Stripe. By taking bold decisions, the company aims to secure its position as a leading player in payments and beyond.

Looking forward, here’s what we expect:

Expansion in Emerging Markets: With significant untapped potential in markets like Asia and Africa, Stripe may pivot additional resources toward scaling across these geographies.

Focus on Developer-Driven Growth: Stripe has always been well-loved by developers for its user-friendly APIs. Future enhancements in developer experience could be a promising area for reinforcing its base.

Sustainability Initiatives: With global scrutiny on ESG (Environmental, Social, and Governance) practices, we could see Stripe investing in sustainability within its operational and product frameworks.

Ultimately, while layoffs create tough transitions, they are often necessary for companies to thrive over the long term. Stripe remains one of fintech’s most stable and innovative enterprises and, with these strategic pivots now in motion, could unlock new opportunities in the years ahead.